We all have the same 24 hours in a day, yet the outcomes we achieve in life vary dramatically.

When I was a kid, people kept telling me that hard work was the key to success. But I saw my mom working two jobs—and we were still poor.

Later, others said education was the secret. If I studied hard, got into a good university, and landed a good job, success would follow.

But that didn’t seem to hold true either. I met people with PhDs who were still struggling to find work.

Clearly, something was missing.

I didn’t grow up around wealthy people, so I turned to books—trying to gather insights one page at a time.

But reading alone wasn’t enough. Real learning came from real life. After 13 years in the trenches, I finally began to see things clearly.

I realized how limited my knowledge was. So I started building mental frameworks—tools to help me understand success faster.

Table of Contents

ToggleSuccess Comes From Managing Your Resources Well

My parents used to warn me that playing video games would ruin my future. But honestly, games like Starcraft and Age of Empires gave me some of the most engaging experiences of my childhood.

Those were strategy games—and to win, you had to manage your resources wisely.

Real life is no different.

Think back to your high school years. Some people wasted their time partying and messing around. Others focused on studying and joined extracurricular activities.

Generally speaking, the students who used their time more wisely ended up doing better in life—though, of course, there were exceptions.

But it wasn’t just about hard work. It was about how they managed their resources.

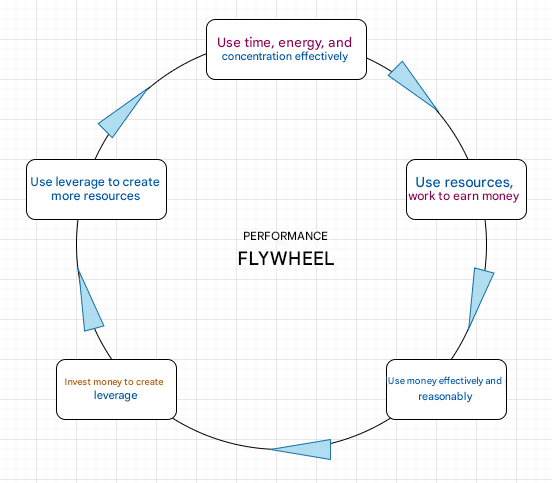

Today, I want to share a mental model I call the Performance Flywheel.

The idea comes from the book Good to Great. At first, it takes an enormous amount of effort to get the wheel turning. But once you build enough momentum, it starts spinning on its own.

Ever heard the phrase “the rich get richer”?

That’s the flywheel effect in action. I started paying attention to how I was using my own resources—time, energy, focus, money. I realized I needed to apply leverage: use what I had to gain even more.

The performance flywheel is a framework to help you maximize the leverage in your life.

Understanding and Applying the Performance Flywheel

Let’s break down how this system actually works—and more importantly, how you can use it to get more done without burning out.

Once you understand the mechanics behind the flywheel, you’ll start to see how small, consistent actions can create massive long-term results.

Step 1: Leverage Your Core Resources—Time, Energy, and Focus

Every one of us is given the same basic set of resources:

- Time – You get 24 hours in a day.

- Energy – This is your capacity to take action. Ever tried working a full day without sleep? That’s what hitting zero energy feels like.

- Focus – Your ability to concentrate. It’s one of the most undervalued resources. If you’re checking social media every few minutes, how can you expect to get meaningful work done?

If you want to accomplish more, these three are non-negotiable.

You’ve probably heard people say, “We all have the same 24 hours.” But that’s only partially true.

If you commute three hours a day just to get to work, and I work from home, I effectively have three extra hours than you.

In a few years, I plan to have kids. When that time comes, I’ll have fewer resources than I do now.

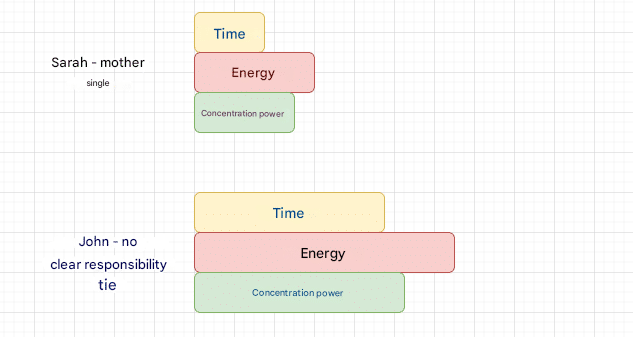

Let’s look at two examples:

Sarah is a single mother who spends three hours a day commuting. By the time she gets home, she’s exhausted.

John just graduated college. His parents cover his living expenses, so he has full control over his schedule.

Obviously, John has a better shot at getting things done.

This is reality: Life isn’t fair.

Some people are born into difficult families and grow up in poverty. Others are born into supportive, wealthy homes.

It’s like playing a card game. You don’t get to choose the hand you’re dealt—but you do get to choose how to play it.

In the early stages of life and career, avoid putting yourself in a disadvantaged position.

If you just graduated college, are buried in six figures of student debt, and can’t get a job—you’re playing life on “hard mode.”

If you’re a single father at 16, you’re playing on “extreme mode.”

Every day, you make dozens of decisions about how to invest your time, energy, and attention.

Wasting your life resources looks like this: binge drinking all day. Scrolling Facebook endlessly. Sure, it’s fun in the moment—but you’re draining your most valuable resources.

So What Does It Mean to Invest Your Resources?

It means putting your time, energy, and money into activities that generate more resources in return.

Let’s break it down:

Time:

- Use a calendar to plan your day.

- Install website blockers to eliminate distractions while working.

- Meal prep in bulk—cook once, eat twice.

Energy:

- Get 8 hours of sleep every night.

- Exercise at least three times a week.

- Eat a clean, healthy diet.

- Meditate for at least 10 minutes a day.

- Limit your screen time and social media usage.

- Use timeboxing or the Pomodoro Technique while working.

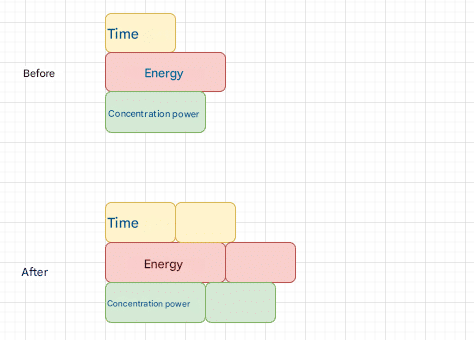

Take Sarah, the single mom we talked about earlier. She doesn’t have a lot of resources. But she can still train herself to build better habits.

She can build systems that make her more efficient, so she regains control over her time, energy, and focus.

This approach requires discipline.

And I’ll be honest with you—it’s not easy.

There are days I don’t feel like going to the gym. I’d rather play video games.

There are nights I just want to binge-watch shows instead of going to bed early.

But I stay focused on the bigger goal. I’ve realized that every bad habit slowly steals the future I want to build.

So the first step is this: maximize the resources you already have.

Each day, ask yourself:

- How much time do I really have today?

- How much energy do I have?

- How much focus can I give?

Then turn those resources into the fourth one: money.

Step 2: Use Your Resources and Work to Generate Money

You take your core resources—time, energy, and focus—and pour them into a machine: your job or your business. The output? Money.

But not all work pays equally.

Two people might put in the same amount of effort, yet walk away with wildly different paychecks.

One consultant might charge $100 an hour. Another? $10,000 an hour.

Getting paid more isn’t something that just happens because you “try harder.” It requires deliberate strategy. Here are a few ways to increase your earning potential:

- Invest in education and acquire valuable knowledge.

- Negotiate for higher pay in your current role.

- Switch to a company that pays more.

- Spend time mastering high-income skills.

- And more…

Life isn’t fair.

Let me say that again: Life isn’t fair.

There’s a developer in Romania who earns about $25 an hour. He’s extremely talented.

But if he were born and raised in the U.S., he might be making $200,000 a year. He’s the same smart person—but his environment limits what he can earn.

Sometimes, your income has nothing to do with your ability—and everything to do with where you are, who you know, or the market you’re in.

Step 3: Use Your Money Wisely

People love to say, “Money can’t buy happiness,” or “Money isn’t that important.” Often, that’s just an excuse for why they’re stuck—and why they’re not moving forward in life.

Money isn’t good or bad. It’s just a resource.

Unfortunately, no one really teaches us how to manage it. And no, it’s not just about plugging numbers into a spreadsheet.

Money can mean many things:

- Money is opportunity.

- Money can be a status symbol.

- Money can be a safety net for the future.

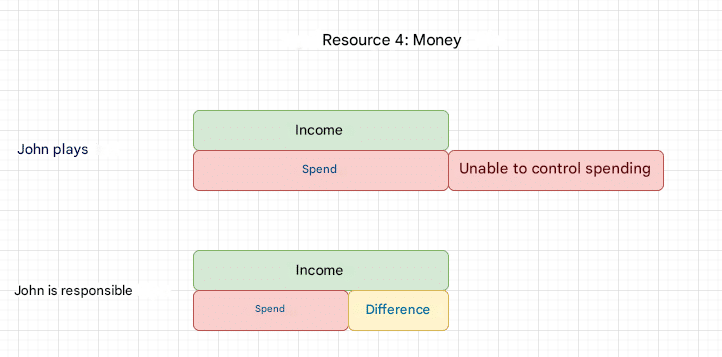

To take full responsibility for your finances, you need to embrace a simpler lifestyle.

It doesn’t matter how much you earn—if you can’t control your spending, you’re on the fast track to going broke.

You’ve probably heard stories of lawyers or athletes who went bankrupt.

They had huge incomes—but even bigger expenses.

Learning to save money is what creates real leverage.

Leverage = Income – Expenses

Most people never build true leverage. They trade time, energy, and focus for money—and then spend it all.

And that cycle repeats, endlessly—until they’re too old to work and too broke to stop.

Long-Term Thinkers Always Win.

Most people don’t have leverage.

They trade time, energy, and money—just to make a bit of money.

Then they spend all of it.

The cycle repeats.

And that’s why so many people can’t retire peacefully.

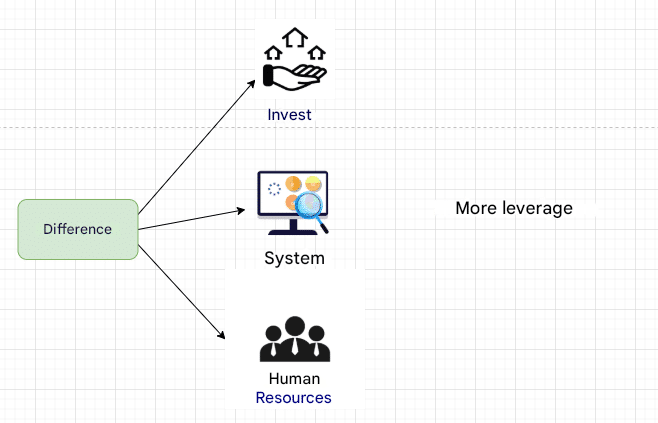

Step 4: Invest Money to Create Leverage

Leverage is power.

It’s how you get more done without putting in more hours or effort.

Imagine trying to move a 40kg object by hand. Tough, right?

Now put it on a rolling cart. Suddenly—it’s easy.

That rolling cart? That’s leverage.

And money is one of the best ways to buy leverage.

There are three main ways to do it:

- Investments

- Systems

- People

You already know what investing is.

There are countless options: stocks, real estate, crypto, bonds, gold, businesses.

Here’s a simple formula:

(Money) × (Time) × (Strategy) × (Risk) = More Money

If you’re planning to invest, ask yourself:

How much of your resources are you really willing to commit?

Personally, I like investing in Vanguard index funds.

A few years ago, I took time to study investing.

But honestly? I don’t obsess over it.

I don’t spend hours tracking the market.

My real strength is in business—and that’s where I focus.

On the other hand, I’ve seen people invest without doing the research.

That’s a disaster waiting to happen.

A friend of mine once invested in a nightclub.

My guess? He just liked the idea of calling himself “a club owner.”

It was a terrible investment.

He wasted time, money, and energy working nights—while neglecting his real business.

Invest in Systems and Technology

We live in the age of technology—and that means you can invest money into tools that give you more time, energy, and efficiency.

Here are a few examples:

- In the past, people washed clothes by hand. Now? You buy a washer and dryer.

- If you run a business, you can invest in automation tools. For example, a restaurant can save thousands by using a reservation system like OpenTable.

- Self-driving cars. I don’t own a Tesla, so I can’t speak from experience. But just imagine: a car that drives itself while you nap in the backseat or catch up on emails—saving you both time and energy.

Technology is one of the highest-leverage investments you can make—if you use it intentionally.

Invest in People (Human Resources)

Your personal resources are limited.

The good news? You can spend money to rent other people’s resources.

Here are a few real-life examples from my own life:

- House Cleaning: Every Sunday, a cleaner comes to my home for 4 hours. I pay them $100, and in return, I get 4 hours of my life back—to focus on higher-leverage activities like planning, thinking, or even resting.

- Childcare: Raising kids is incredibly demanding. My wife and I have planned to hire a nanny in the future—to lighten the load and protect our energy.

- Employees: Hiring someone is one of the biggest forms of leverage. If you hire an employee at $40,000 a year, you’re effectively gaining access to their time, energy, focus, and expertise.

Buying other people’s time isn’t lazy—it’s smart. It allows you to multiply what you can get done.

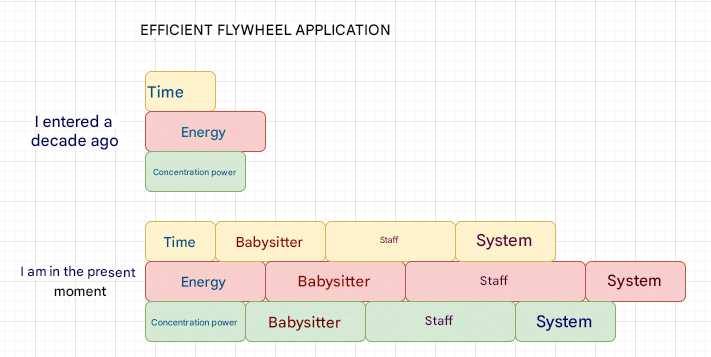

Step 5: Use Leverage to Create Even More Resources

Over a decade ago, I was working a typical 9-to-5 job—trading time for money.

After years of grinding and learning the hard way, I’ve reached a different place. Today, I have more resources than I did back then.

Why?

Because I used money as leverage—to build systems, to invest in tools, and to buy other people’s time and expertise.

Now, imagine what this looks like for a billionaire.

Take Jeff Bezos, for example. Even while he’s on vacation, he’s leveraging the time, knowledge, and energy of over 750,000 people.

Thousands of engineers in Seattle. Thousands of delivery drivers worldwide. And even people like us—writing product reviews, creating content, and making Amazon’s ecosystem more valuable.

Yes, you can build wealth by trading your own time and effort—say, as a consultant or lawyer. That path can make you rich.

But your resources are limited. You still need to sleep.

Machines don’t.

Systems don’t get tired.

Software doesn’t catch the flu.

When you invest in tools, systems, and technology, you tap into unlimited leverage.

The final stage of the flywheel is this: you start creating more resources than you use.

- You gain time to think, to plan, to strategize.

- You become physically healthier—because you can rest properly.

- You can finally focus on the things that truly matter:

- Time with family.

- Time for hobbies.

- Time to live.

There are levels to leverage—and each level multiplies your power.

Here’s what that looks like:

Household Leverage:

- Level 1: Hire a cleaner once a month

- Level 5: Weekly cleaning service

- Level 10: A full-time housekeeper managing multiple tasks

Technical Leverage:

- Level 1: Hire someone on Fiverr to help you write a bit of code

- Level 5: Hire a skilled developer to work on your team

- Level 10: Build an elite team of developers led by a manager who ships full projects without your involvement

This is how the rich get richer.

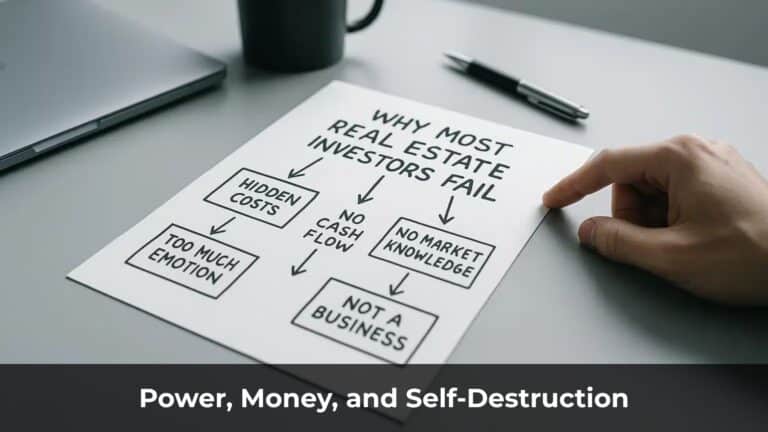

When the Flywheel Breaks

It all sounds great on paper. But when it comes to execution, things can fall apart.

So—when does the flywheel fail?

1. When you play the status game.

The status game is all about trying to look successful.

You’ve seen it: people flexing their new cars, luxury vacations, designer homes.

And look, if you’ve truly earned it—go ahead and celebrate.

But some people make $100K a year and drop $70K on a car.

That $70K could’ve been used to create leverage—to build systems, teams, or tools. They could’ve bought the car next year, when they were operating at a higher level.

So don’t play the status game. It’s distracting. It keeps you stuck.

Don’t try to look rich. Work on becoming actually rich.

2. When you invest too much—but don’t get a return.

Maybe you spend $65,000 a year on a virtual assistant.

They save you tons of time and energy.

But what do you do with that free time?

If you just scroll Instagram or watch Netflix, you’re burning cash—not creating value.

3. When your work or business isn’t profitable.

You’re putting in 14-hour days. Bleeding sweat and tears.

And yet—you’re only earning $50K a year.

Or maybe you’re running a business that keeps losing money, year after year.

In that case, the flywheel breaks down.

Because no matter how hard you push—if the machine isn’t built right, it won’t spin.

Final Thoughts: Mastering the Productivity Flywheel

At first, this concept can feel abstract—maybe even confusing.

And honestly, it’s hard to embrace.

Why hire a cleaner when your spouse could just tidy up?

Why bring in a nanny when you could raise your child full-time?

But if you’re building a business, you’ll eventually understand the weight of being a lone warrior.

It’s hard to trust someone else with your campaigns.

It’s even harder to trust someone with your kids.

Still—you can’t do everything alone. Your time, energy, and focus are limited.

That’s why mastering the productivity flywheel matters.

It’s how you do more, earn more, and ultimately—build real wealth.

Wishing you strength, clarity, and success on the journey.