Let’s be real.

Most people jump into affiliate marketing chasing the dream: passive income, quitting the 9-to-5, maybe even working from a beach somewhere.

The allure of finding that perfect offer, crafting a killer landing page, and watching the commissions roll in is powerful.

But there’s a crucial, often overlooked, foundation that separates fleeting wins from long-term success: your finances.

Yeah, I know.

Talking about accounting, cash flow, and company structures isn’t nearly as thrilling as discussing conversion rates or the latest traffic source.

It feels… dry. Unsexy, even.

That’s why so many affiliates, especially when starting out, completely ignore the money management side.

They scrape together a small budget, maybe a few hundred dollars, cross their fingers, and hope for the best.

They treat it like buying a lottery ticket.

This is a fundamental, business-breaking mistake.

Neglecting your financial foundation is like building a skyscraper on quicksand.

You might see some initial success, a few promising commission reports.

But the first real challenge – a banned ad account, a paused offer, rising ad costs, a delayed payout – sends the whole structure crashing down.

Let me be clear: this article isn’t formal financial or legal advice.

I’m not your accountant or lawyer.

What I am doing is sharing the hard-earned lessons, the painful mistakes, and the practical strategies I’ve learned.

These insights come from navigating the financial realities of building a real affiliate marketing business.

They are forged in the trenches, designed to help you build something solid, something sustainable.

This stuff might not be glamorous, but it’s arguably the most important aspect of turning affiliate marketing from a hobby into a reliable income stream.

So grab a coffee, settle in, and let’s talk about the money.

Table of Contents

ToggleStop! Don’t Form That Company (Yet): When Incorporation Makes Sense

One of the first questions I hear from aspiring affiliates is:

“Should I set up an LLC (or Ltd company in the UK) right away?”

The emphatic answer is usually:

Absolutely not. Hold your horses.

In those exciting, chaotic early days, your income is unpredictable.

Rushing to incorporate is often counterproductive when you’re still figuring things out.

Setting up a formal company structure (LLC/Ltd) comes with baggage:

- Legal fees

- Accounting costs

- Annual filings

- Tax complexities

These drain your limited time and capital before you’ve even proven the business model.

Your initial focus should be laser-sharp:

- Mastering your craft: Ads, traffic, funnels.

- Market intelligence: Niche, offers, networks, audience.

- Consistent profitability: Making money reliably, even small amounts.

So, when is the right time to consider forming a company?

It’s less about a magic number and more about milestones:

- Steady Income: Reliably clearing $1,000-$2,000+ profit monthly (guideline).

- Tax Optimization Needs: When potential tax savings outweigh costs (consult a pro!).

- Liability Concerns: Partnerships, high-risk offers, separating assets.

- Professionalism & Growth: Contracts, hiring, investment, branding.

Think of it this way:

Generate the profit first. Then, strategize how to protect and optimize it.

Incorporating too early won’t magically boost earnings.

But doing it strategically, at the right moment, provides crucial benefits:

- Liability protection.

- Doors for tax planning.

- Sets the stage for sustainable growth.

It signals you’re moving from a side hustle to a serious business.

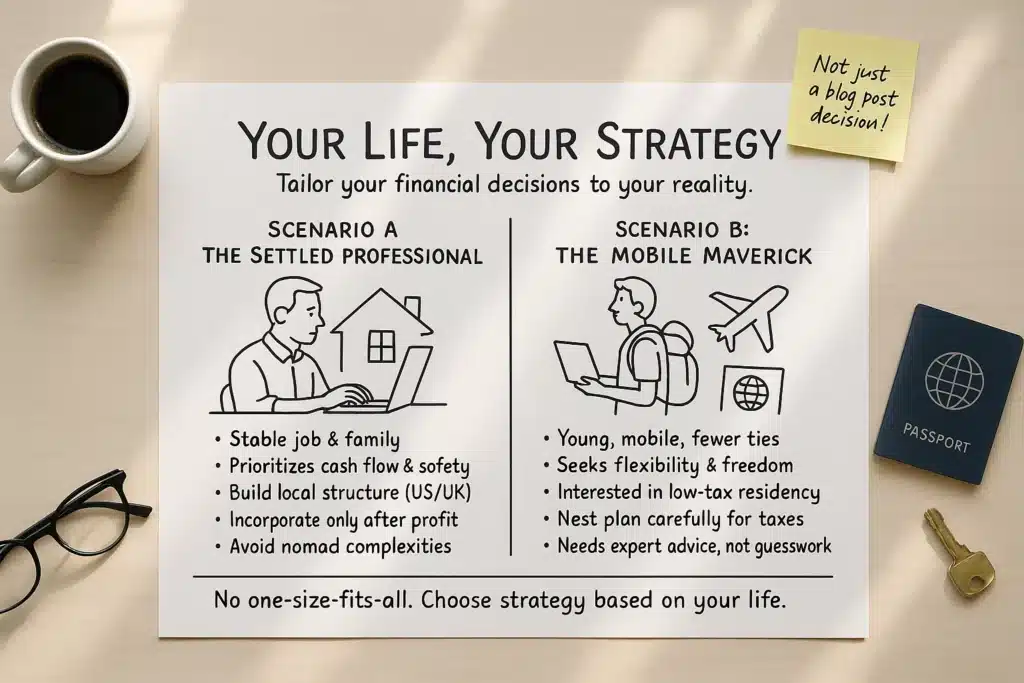

Your Life, Your Strategy: Tailoring Finances to Reality

Before thinking about LLCs vs. S-Corps, take a reality check.

Your personal situation dictates your financial strategy far more than generic online advice.

There’s no one-size-fits-all approach.

Consider these scenarios:

Scenario A: The Settled Professional

You have a stable job, maybe a family, a mortgage.

You’re building your affiliate business on the side.

- Priorities: Stability, predictable cash flow, minimizing personal risk.

- Strategy: Build a solid financial structure locally (US/UK). Track everything. Incorporate when profits are consistent and protection matters.

The “digital nomad” complexities might not be worth the initial hassle.

Scenario B: The Young & Mobile Maverick

You’re single, perhaps younger, fewer ties, desire location independence.

The “digital nomad” dream is strong.

- Priorities: Flexibility, potentially lower cost of living, travel.

- Strategy: Explore low-tax residency (complex, needs expert advice). Manage physical presence carefully to avoid triggering tax elsewhere (e.g., <183 or <90 days).

This path requires meticulous planning, record-keeping, and professional guidance on international tax law.

It’s not just hopping on a plane.

Crucial Point: Tax laws shift constantly. What worked last year might be illegal now. Never base major financial decisions on blog posts (even this one!).

Always consult qualified tax professionals relevant to your citizenship and intended base.

The fundamental lesson?

Stop copying others blindly.

Analyze your situation, your goals, your risk tolerance.

Then, build a financial strategy that serves you.

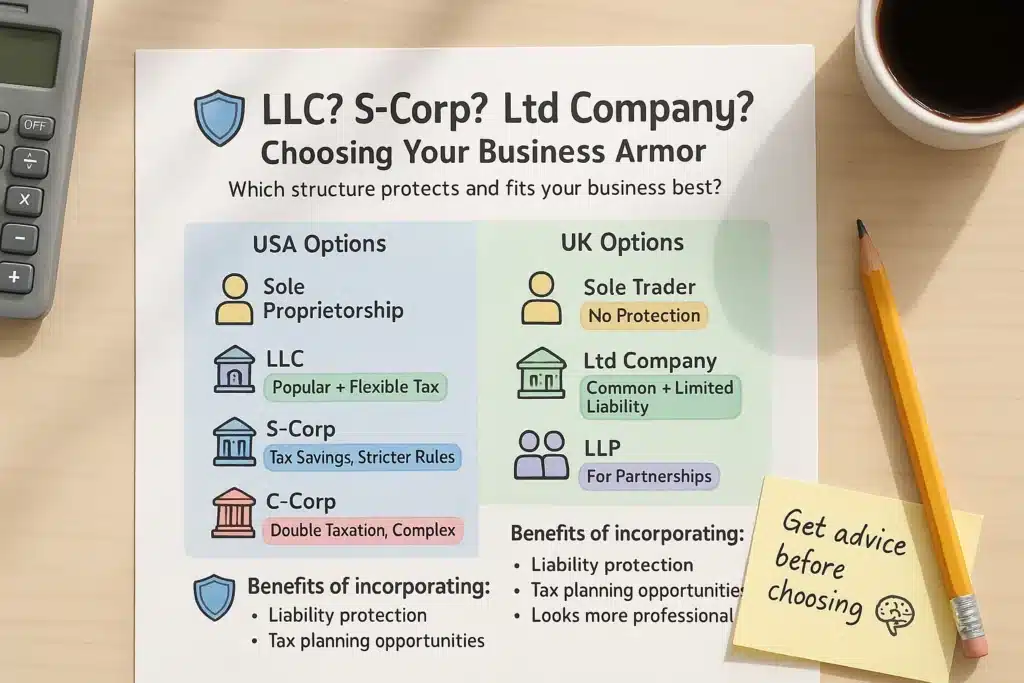

LLC? S-Corp? Ltd Company? Choosing Your Business Armor

Okay, you’ve hit those milestones.

It’s time to graduate from operating as a sole proprietor/trader.

Why? Because without a formal structure, you ARE the business.

If your business gets sued or racks up debt, your personal assets are potentially fair game.

Forming a separate legal entity (LLC/Ltd) creates a crucial shield.

It establishes the business as its own “person” legally, separating its liabilities from your personal finances.

The Main Contenders (Simplified):

USA:

- Sole Proprietorship: Default. Easy, no protection.

- LLC: Popular. Liability protection, flexible tax.

- S-Corp: Tax election (often for LLCs). Potential self-employment tax savings, stricter rules.

- C-Corp: More complex. Corporate tax + personal tax on dividends.

UK:

- Sole Trader: Default. Easy, no protection.

- Ltd Company: Common. Limited liability. Corp Tax + personal tax on salary/dividends.

- LLP: For partnerships. Limited liability for partners.

Key Benefits of Incorporating (LLC/Ltd):

- Liability Protection: The BIG one. Protects personal assets.

- Potential Tax Advantages: Might allow structuring compensation (salary vs. dividends) to lower overall tax vs. sole prop/trader. Requires accountant planning.

- Credibility & Professionalism: Looks more established.

Massive Disclaimer: Tax optimization is complex and jurisdiction-specific. Salary vs. dividend rules apply (e.g., IRS “reasonable compensation”). Corporate profits are taxed before dividends. DO NOT DIY. Consult a qualified accountant/tax advisor in your country/state.

The Bottom Line: Once profits are consistent and significant, get professional advice to set up the right legal structure (LLC/Ltd). It’s a smart investment.

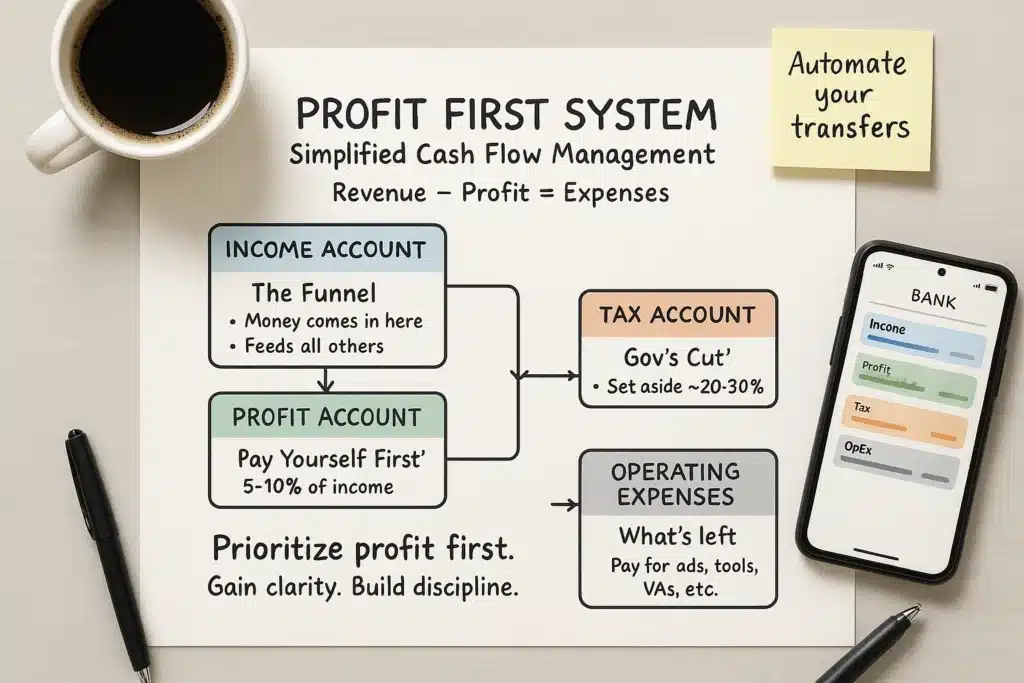

Taming the Beast: Managing Cash Flow with the Profit First System

Got your new company and business bank account? Progress!

But one account for everything is financial chaos. You can’t see your true health.

Enter a simplified approach inspired by Mike Michalowicz’s “Profit First.“

The core idea? Allocate money with purpose before spending.

It flips the script: Revenue – Profit = Expenses. Prioritize profit first.

Here’s a practical, multi-account system:

1. Income Account (The Funnel):

- Purpose: All revenue lands here.

- Action: Money comes in, doesn’t stay long.

2. Profit Account (Pay Yourself First):

- Purpose: Holds your actual business profit.

- Action: Regularly transfer a set % (start small, 5-10%) from Income. This is sacred.

- Use: Funds your owner’s compensation.

3. Tax Account (Gov’s Cut):

- Purpose: Sets aside money for all taxes.

- Action: Simultaneously transfer estimated tax % (e.g., 20-30%+, ask accountant!) from Income.

- Use: ONLY for paying taxes. Never touch.

4. Operating Expenses (OpEx) Account (Run the Business):

- Purpose: Funds day-to-day operations.

- Action: Whatever’s left in Income after Profit/Tax transfers goes here.

- Use: Pay for ads, tools, software, VAs, etc.

Why is this system transformative?

First, it forces profitability by taking your profit off the top — not as an afterthought, but as a priority.

Second, it brings instant clarity: you can immediately see how much is reserved for taxes, profit, and operations, instead of wondering if your balance is “safe” to spend.

And finally, it builds financial discipline by removing the temptation to dip into tax or profit reserves. A smaller OpEx balance naturally forces you to question every expense.

Setting this up needs discipline, maybe extra free bank accounts.

Automate transfers if possible.

It feels restrictive initially but provides unparalleled control and peace of mind.

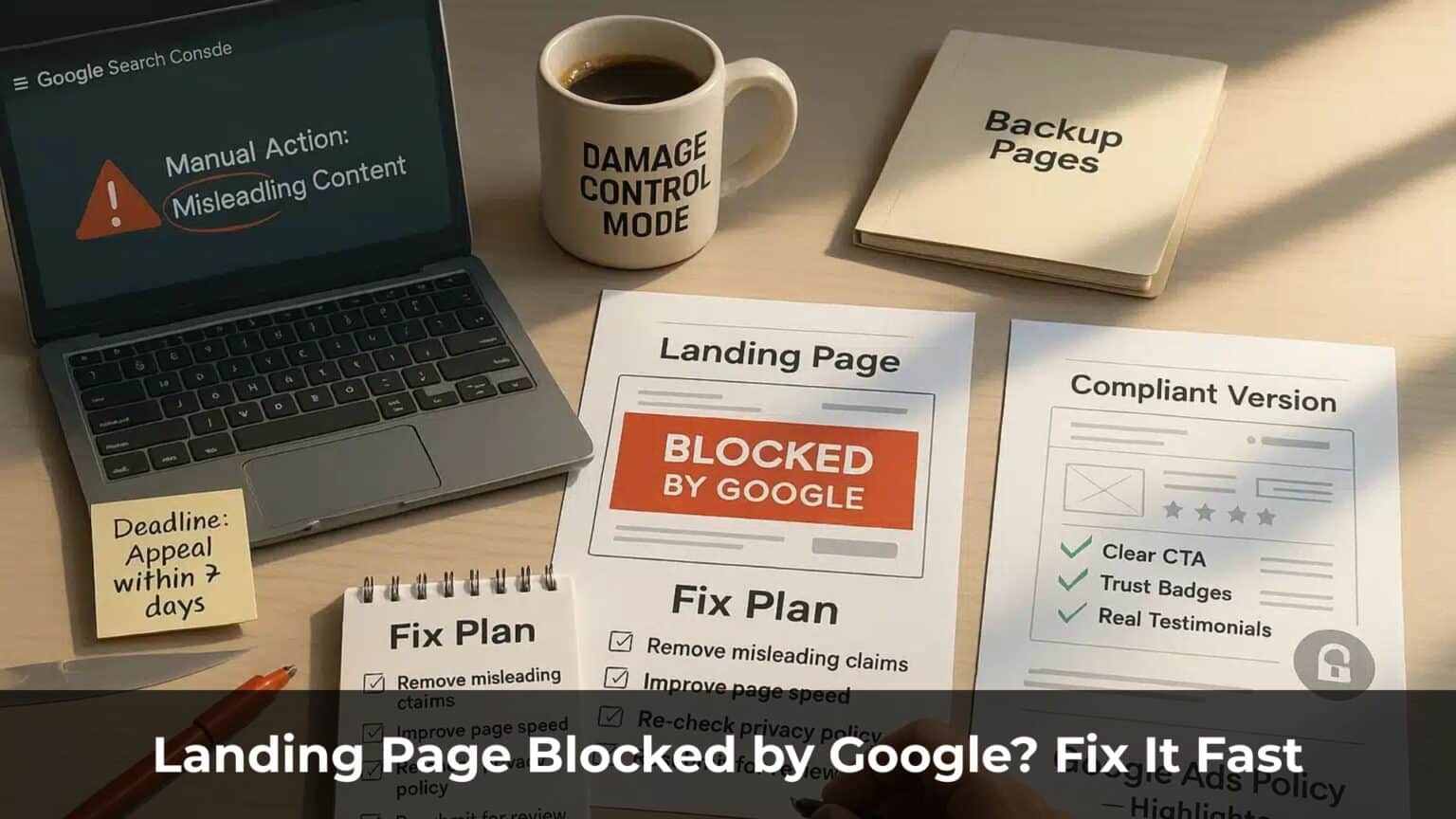

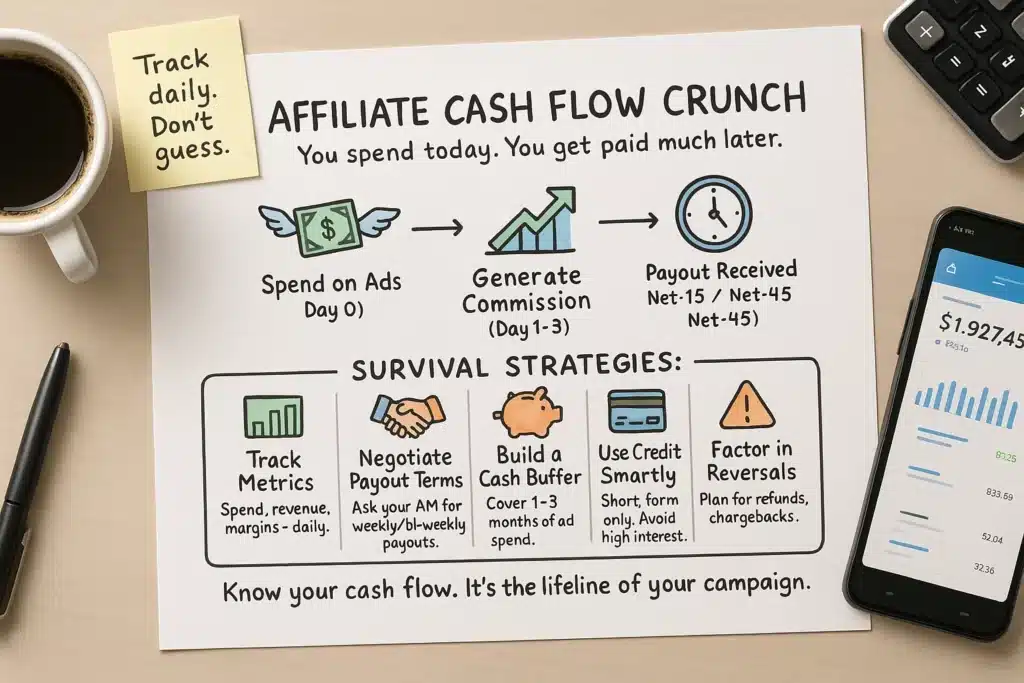

The Cash Flow Crunch: Surviving the Affiliate Payment Lag

Affiliate marketing has a unique challenge: the cash flow gap.

You spend on ads today.

You generate commissions quickly.

You get paid weeks or months later (Net-15, Net-30, Net-45+).

This delay can cripple profitable campaigns if unmanaged.

Essential Cash Flow Survival Tactics:

- Know Metrics Religiously: Track daily spend, revenue, profit margins. Use tracking software.

- Negotiate Faster Payouts: Ask your AM for faster terms (weekly, bi-weekly) once proven.

- Build a Cash Buffer: Non-negotiable. Cover at least one payment cycle’s expenses (esp. ads). Aim for 1-3 months OpEx safety net.

- Use Business Credit Strategically (Caution!): Can bridge short-term gaps for ads. Treat as float, pay off fast. Avoid high interest.

- Factor in Reversals: Account for refunds, chargebacks, lead adjustments. Don’t count unhatched chickens.

Poor cash flow management sinks more affiliate businesses than bad campaigns. Stay aware of money in vs. out vs. owed.

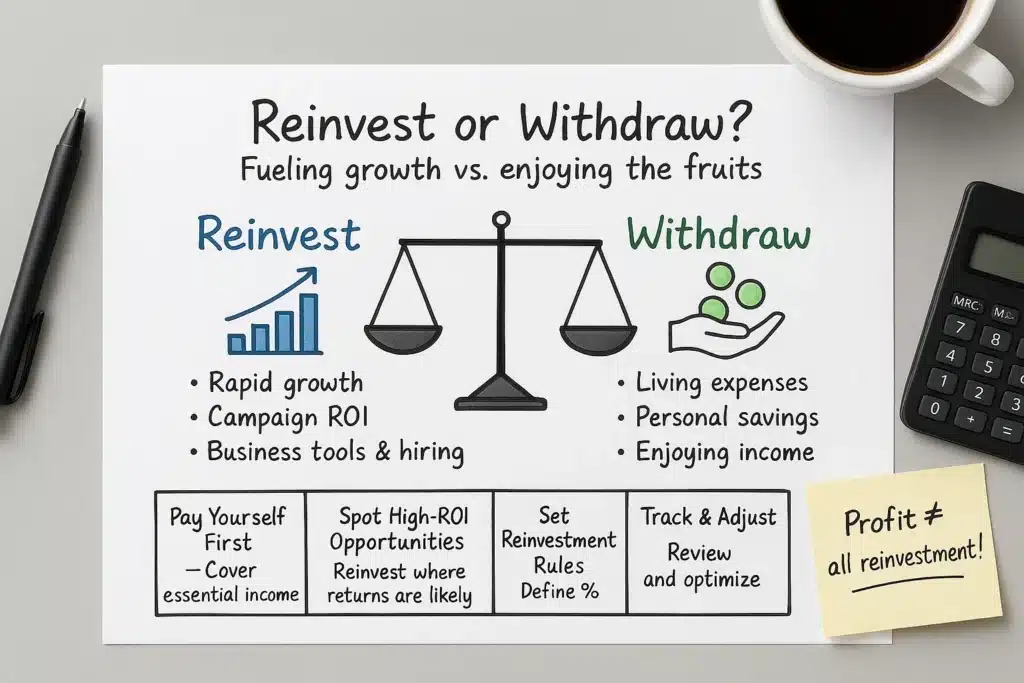

Reinvest or Withdraw? Fueling Growth vs. Enjoying the Fruits

Congratulations, you’re consistently profitable!

Now the question: how much profit to reinvest vs. withdraw personally?

There’s no single right answer.

It’s a balancing act influenced by:

- Your Goals: Rapid growth vs. stable income?

- Risk Tolerance: Comfortable scaling spend?

- Campaign ROI: Strong, scalable returns?

- Business Needs: Critical tools, training, hires?

- Personal Needs: Living expenses, financial goals?

A Practical Framework:

- Pay Yourself First: Ensure Profit account covers essential income/savings.

- Identify High-ROI Opportunities: Where will reinvestment have the biggest impact?

- Set Reinvestment Guidelines: Decide % of remaining profit (after pay/tax) for growth.

- Track and Review: Monitor results. Adjust strategy based on data.

The key is sustainability. Don’t starve yourself or bleed the business dry. Find equilibrium for long-term thriving.

Conclusion: Graduate from Affiliate Marketer to Business Owner

Let’s circle back.

Finance might be the least “sexy” part, but mastering it is key.

It’s the difference between a temporary cash machine and a resilient, long-term business.

Ignoring finances is like trying to win a marathon in flip-flops. You won’t finish strong.

Key Takeaways to Internalize:

- Profits First, Structure Later: Make money before complex setups.

- Armor Up: Incorporate (LLC/Ltd) strategically. Get pro advice!

- Command Your Cash: Use Profit First system for clarity/control.

- Bridge the Gap: Manage cash flow lag actively.

- Personalize Your Plan: Align strategy with your life/goals.

- Balance Growth & Reward: Reinvest wisely, pay yourself sustainably.

Building a successful affiliate business demands more than marketing savvy.

It requires the discipline and foresight of a true business owner.

Treat your finances seriously. Manage money with intention.

You’ll build something that not only generates income but lasts.

Now, go build that solid foundation.