I’ve watched family members fall into this trap with my own eyes.

They thought they were investing, but in reality, they were gambling with their life savings.

They believed real estate always goes up, believed that “prime property” would deliver financial freedom, but ended up becoming slaves to bank loans and monthly payment pressures instead.

This kind of blind faith in real estate investment is more common than you think.

Warning: This article might completely change how you view the real estate market. If you’re planning to invest anytime soon, read every section carefully to avoid costly mistakes that could cost you decades of financial progress.

Here’s something to think about: If a house or piece of land is truly a profitable asset, why does the current owner want to sell it?

If it’s really “gold,” why aren’t they keeping it to enjoy the profits?

The simple answer: Because for them, that “asset” has become a burden.

Maybe it’s financial pressure – they need cash urgently to solve other problems. Maybe it’s maintenance costs that are too high – from property taxes and HOA fees to repair expenses that seem to multiply every month.

Maybe it’s changes in personal circumstances – job relocation, family changes, or simply the harsh realization that this investment isn’t delivering the expected results they were promised.

But instead of admitting these problems, the market creates a different narrative.

They call it an “investment opportunity,” an “asset with appreciation potential,” a “prime location with strong fundamentals.”

They don’t talk about sleepless nights worrying about mortgage payments, don’t mention months of cutting expenses to cover carrying costs, don’t discuss the helpless feeling when watching comparable properties in the area sit unsold for months.

And that’s exactly when the problem game begins.

Table of Contents

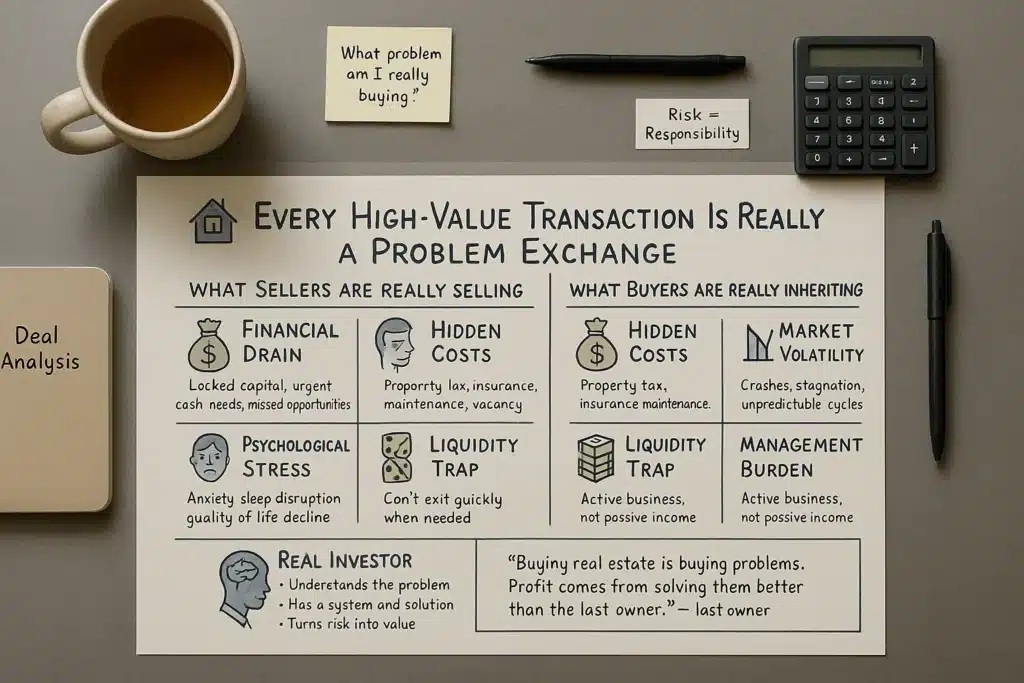

ToggleEvery High-Value Transaction Is Really a Problem Exchange

To understand the true nature of the real estate market, you need to fundamentally change how you view buying and selling transactions.

This isn’t simply exchanging money for assets. This is exchanging problems.

The seller isn’t just selling physical items – the house, the land – they’re transferring their entire problem portfolio to you. These problems might include:

Financial Drain Issues: They need cash immediately to handle debt consolidation, unexpected medical expenses, or capitalize on other investment opportunities that actually generate positive cash flow.

The property is “freezing” a massive amount of capital that they can’t deploy flexibly. While their money sits locked in bricks and mortar, they’re watching other investors generate monthly income from dividend stocks, REITs, or business investments.

Time and Energy Hemorrhaging: Managing real estate demands enormous time and mental bandwidth. From screening potential tenants and collecting rent to coordinating repairs at 2 AM, handling insurance claims, and navigating local housing regulations.

Many property owners describe feeling like they’ve become unpaid property managers rather than investors. They’re trading their time for the illusion of passive income, often earning less per hour than minimum wage when you calculate the real time investment.

Psychological Stress Overload: The pressure from owning large, illiquid assets creates constant underlying anxiety. Every market downturn, every major repair, every vacancy period becomes a source of stress that impacts sleep, relationships, and overall quality of life.

Many describe owning rental properties as feeling like “having a second job that you can’t quit, with tenants who can destroy your asset and leave you holding the bill.”

Opportunity Cost Blindness: When significant capital is locked in real estate, owners miss countless other investment opportunities. While they’re dealing with a leaky roof and difficult tenants, other investors are building diversified portfolios that compound wealth without the headaches.

On the flip side, buyers aren’t just purchasing assets – they’re inheriting all these accompanying challenges. They’ll soon discover:

The Hidden Cost Reality: Beyond the purchase price lies a maze of ongoing expenses that most new investors dramatically underestimate. Property taxes that increase annually, insurance premiums that spike after claims, maintenance costs that average 1-3% of property value yearly, and vacancy periods that can devastate cash flow projections.

According to recent data, the median home price in the US is $414,000, but the true cost of ownership often exceeds $2,000-3,000 monthly when you factor in all carrying costs – not just the mortgage payment that most people focus on.

Market Volatility Exposure: Despite popular belief, real estate markets can be incredibly volatile. The 2008 housing crisis wiped out trillions in property values, and many markets still haven’t fully recovered. Current data shows existing home sales declining 2% year-over-year, with many markets experiencing price stagnation or decline.

Liquidity Trap Reality: Unlike stocks that can be sold in seconds, real estate can take months or years to sell, especially in declining markets. When you need cash urgently, your “valuable” property becomes a financial prison.

Management Responsibility Burden: Whether you’re buying to rent or to flip, you’re signing up for a second career in property management. Every successful real estate investor will tell you the same thing: it’s not passive income – it’s active business ownership with all the associated risks and responsibilities.

Success in real estate investing isn’t about buying “good” properties at “good” prices. It’s about having the knowledge, systems, and financial cushion to solve the problems that previous owners couldn’t handle, and transforming those problems into profitable solutions.

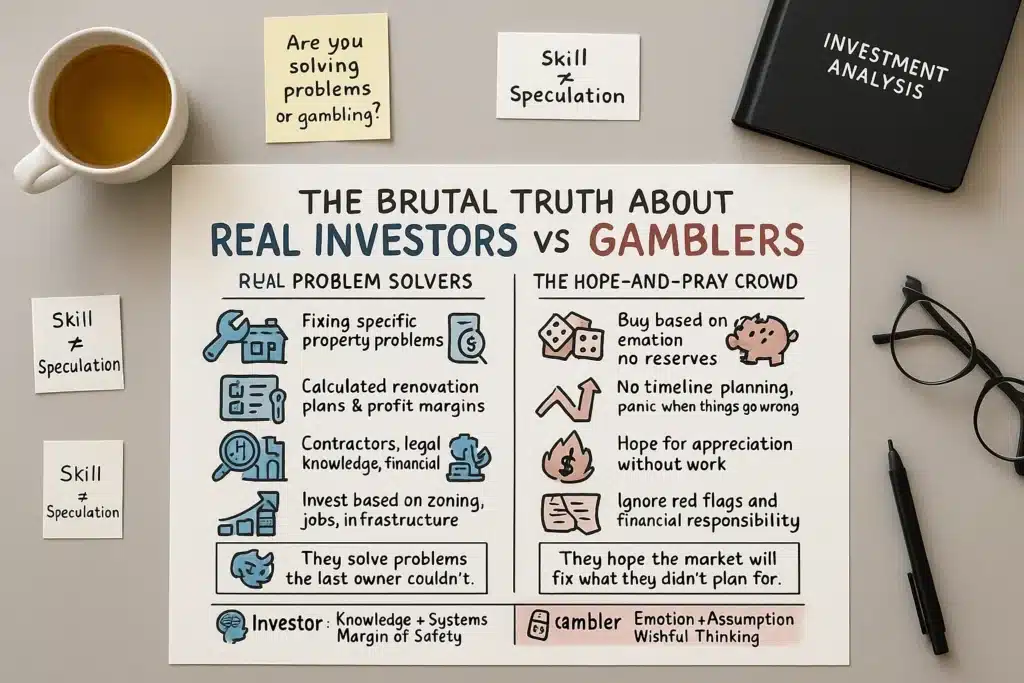

This is what separates real investors from gamblers.

Real investors understand exactly what problems they’re purchasing and have detailed plans to solve them profitably. Gamblers just hope someone else will pay more for the same problems they couldn’t solve.

The Brutal Truth About Real Investors vs “Gamblers”

In the real estate world, there are two distinct types of people participating in the market with completely different approaches and outcomes.

Understanding which category you fall into isn’t just academic – it’s the difference between building wealth and losing your shirt.

Real Investors – The Problem Solvers Who Create Value

Real investors don’t just buy properties – they buy problems with specific plans to solve them profitably.

Take the house flippers who specialize in distressed properties. They’re not just buying cheap houses; they’re purchasing properties with specific, solvable problems. A house with outdated electrical systems, structural issues, or cosmetic damage that scares away typical buyers.

But here’s the key difference: they have the knowledge, relationships, and capital to solve these problems systematically. They know exactly how much each repair will cost, have reliable contractors, understand local building codes, and most importantly, have calculated their profit margins before making an offer.

After purchasing a distressed property for $180,000, they might invest $60,000 in strategic renovations and sell it for $280,000. That’s not luck – that’s creating $40,000 in value through problem-solving skills and market knowledge.

Another example is the buy-and-hold investors who target properties in emerging neighborhoods. They’re not gambling on appreciation; they’re investing based on concrete indicators like new infrastructure projects, job growth data, school district improvements, or zoning changes that will increase demand.

They might buy a duplex in an area that’s currently rough but showing signs of gentrification. They have the financial reserves to handle vacancy periods, the knowledge to screen tenants effectively, and the patience to hold through market cycles while collecting rent and building equity.

These investors create value by improving properties, providing quality housing, and contributing to neighborhood revitalization. They’re not just hoping prices go up – they’re actively making their investments more valuable.

Gamblers – The Hope-and-Pray Crowd

Gamblers in real estate have a completely different approach. They buy properties based on emotion, marketing hype, or the simple hope that prices will automatically rise without any effort on their part.

You see them at real estate seminars, getting excited about “no money down” strategies and “passive income” promises. They buy properties in hot markets at peak prices, often with minimal down payments and maximum leverage, hoping to flip quickly for easy profits.

The statistics are sobering: according to multiple industry sources, approximately 90-95% of new real estate investors fail within their first year. They either lose money on their first deal or get so overwhelmed by the reality of property ownership that they quit entirely.

These gamblers typically make several critical mistakes:

They buy properties that have already been “discovered” by the market and priced accordingly. Instead of finding undervalued assets with solvable problems, they’re paying retail prices for properties that need significant work or are in declining areas.

They underestimate the complexity and cost of real estate investing. They see the potential rental income but ignore vacancy rates, maintenance costs, property management fees, and the time investment required to be successful.

They lack the financial reserves to handle inevitable problems. When the air conditioning dies in July or a tenant stops paying rent, they don’t have the cash flow to handle these situations properly, leading to poor decisions and mounting losses.

Most importantly, they’re investing based on hope rather than analysis. They hope the market will bail them out, hope tenants will be perfect, hope nothing will break, and hope they can sell quickly if things go wrong.

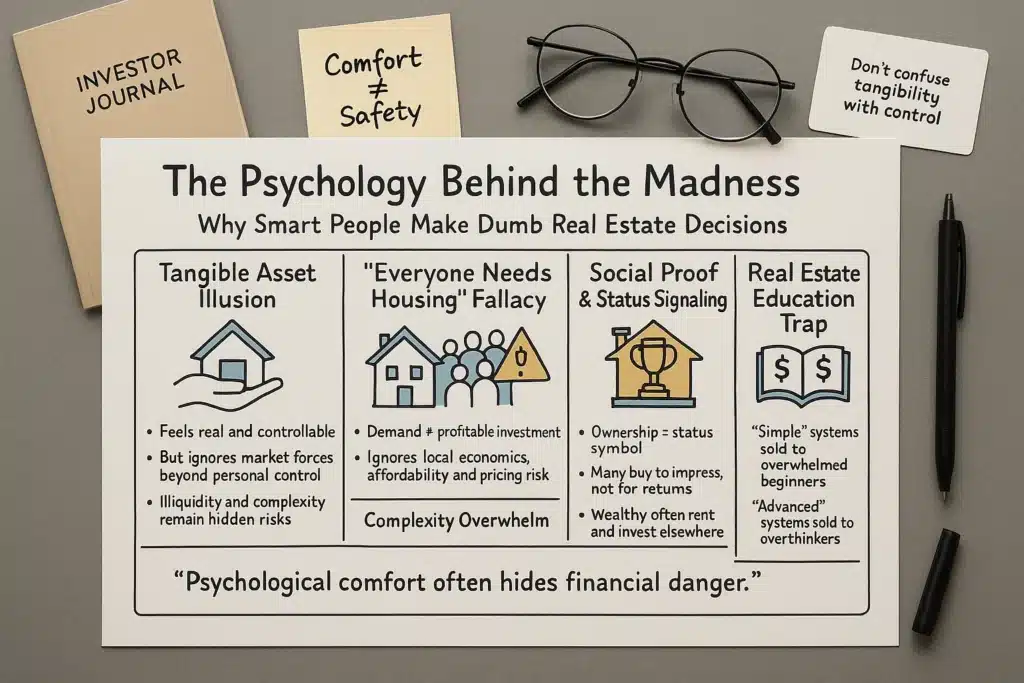

The Psychology Behind the Madness: Why Smart People Make Dumb Real Estate Decisions

Understanding why intelligent, successful people often make terrible real estate investment decisions requires examining the psychological factors that drive these choices.

The “Tangible Asset” Illusion

Many people feel more comfortable investing in real estate because they can see and touch their investment. Unlike stocks, which feel abstract and intangible, a house or building provides psychological comfort.

This tangibility bias leads people to overestimate their control over the investment’s performance. They think, “If something goes wrong, I can fix it myself” or “At least I own something real.”

But this psychological comfort often masks the reality that real estate is actually less liquid and more complex than many other investments. You can’t “fix” a declining neighborhood, changing demographics, or economic downturns that affect property values.

The “Everyone Needs Housing” Fallacy

The logic seems bulletproof: people will always need places to live, so real estate must be a safe investment.

While housing demand is relatively stable, this reasoning ignores crucial factors like location specificity, demographic shifts, economic changes, and the difference between needing housing and being able to afford specific properties at specific prices.

Detroit had plenty of housing demand in 2005, but that didn’t prevent massive property value declines when the automotive industry collapsed. The same pattern has played out in countless cities across America.

Social Proof and Status Signaling

Real estate ownership carries significant social status in American culture. Owning property, especially multiple properties, signals success and financial sophistication.

This social pressure drives many investment decisions that make no financial sense. People buy investment properties not because the numbers work, but because they want to be seen as successful real estate investors.

The irony is that many of the wealthiest individuals rent their primary residences and invest their capital in more liquid, higher-return assets. But this reality doesn’t fit the cultural narrative around real estate ownership.

The Complexity Overwhelm Factor

Real estate investing involves numerous complex factors: market analysis, property evaluation, financing options, legal considerations, tax implications, property management, and exit strategies.

This complexity often leads to analysis paralysis, where potential investors spend months or years “learning” without ever taking action. Alternatively, it leads to oversimplification, where people make major financial decisions based on incomplete information or overly optimistic assumptions.

The real estate industry exploits both tendencies – selling “simple” systems to overwhelmed beginners and complex strategies to those who think they need more sophisticated approaches.

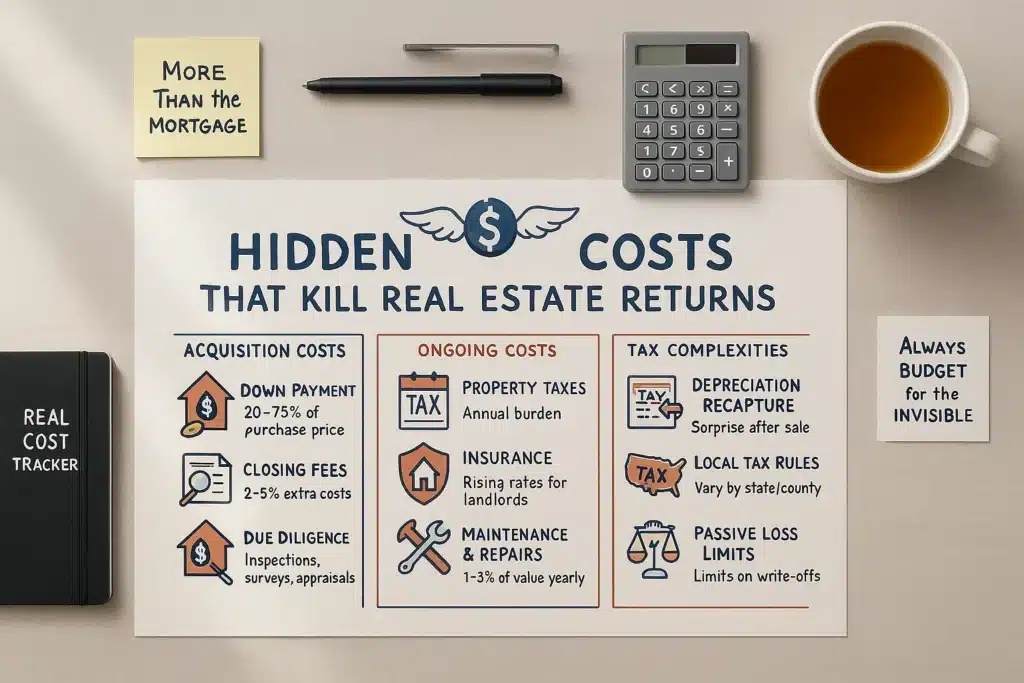

The Hidden Costs That Destroy Real Estate Returns

One of the biggest gaps between real estate marketing and reality lies in understanding the true cost of property ownership. Most new investors focus exclusively on the purchase price and monthly mortgage payment, completely ignoring the dozens of other costs that can make or break an investment.

The Acquisition Cost Avalanche

Before you even own the property, you’re facing a mountain of costs that most investors underestimate:

Down payment requirements have increased significantly. While some programs allow lower down payments, investment properties typically require 20-25% down. On that $414,000 median-priced home, you’re looking at $80,000-$100,000 just for the down payment.

Closing costs typically run 2-5% of the purchase price, including loan origination fees, appraisal costs, title insurance, attorney fees, and various inspections. That’s another $8,000-$20,000 on our median-priced property.

Due diligence costs add up quickly: professional inspections, surveys, environmental assessments, and other evaluations can easily cost $2,000-$5,000 per property, even if you don’t end up buying.

The Ongoing Expense Reality Check

Once you own the property, the monthly costs extend far beyond the mortgage payment:

Property taxes vary dramatically by location but average 1.1% of property value annually nationwide. On our $414,000 property, that’s $4,554 yearly, or $379 monthly.

Insurance costs have skyrocketed, especially in areas prone to natural disasters. Landlord insurance typically costs 25% more than homeowner’s insurance and can easily run $2,000-$4,000 annually.

Maintenance and repairs average 1-3% of property value annually. Even well-maintained properties require regular upkeep: HVAC servicing, plumbing repairs, roof maintenance, exterior painting, and countless smaller issues. Budget at least $4,000-$12,000 yearly for a median-priced property.

Property management fees typically run 8-12% of gross rental income if you hire professionals. On a property renting for $2,500 monthly, that’s $200-$300 monthly in management fees.

Vacancy costs are often overlooked but can be devastating. Even in strong rental markets, expect 5-10% vacancy rates. Higher vacancy rates in weaker markets can quickly turn positive cash flow negative.

The Tax Complexity Trap

Real estate taxation involves numerous complexities that can significantly impact returns:

Depreciation recapture taxes apply when you sell investment properties, potentially creating large tax bills that many investors don’t anticipate.

State and local tax variations can dramatically affect profitability. Some states have no income tax but high property taxes, while others have the opposite structure.

Passive activity loss limitations can prevent you from deducting rental losses against other income, reducing the tax benefits that many investors count on.

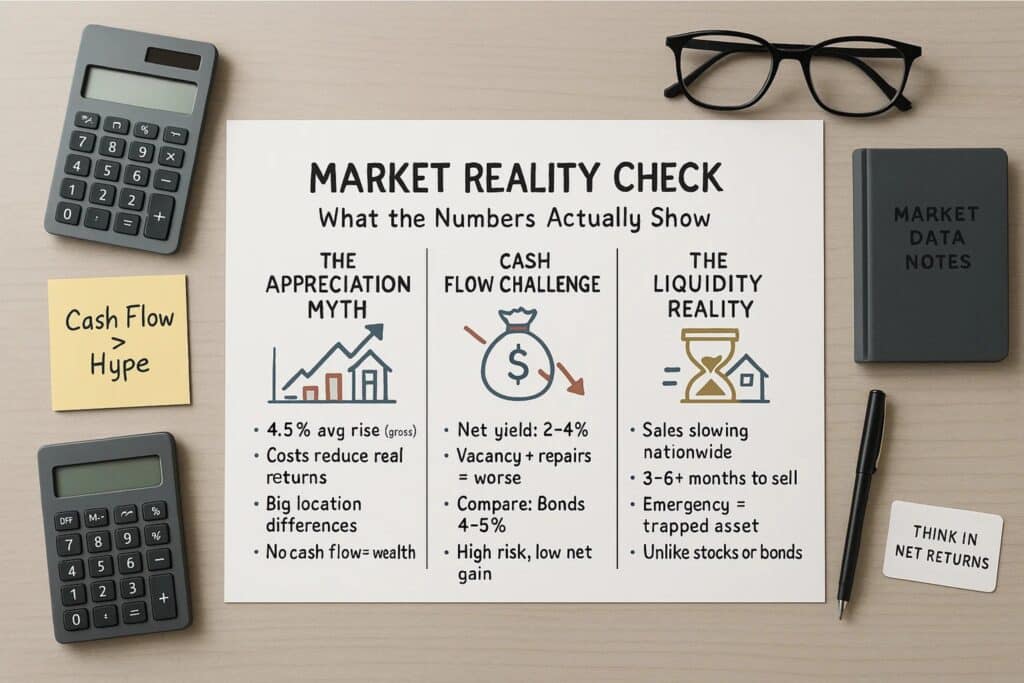

Market Reality Check: What the Numbers Actually Show

Let’s examine what current market data reveals about real estate investment reality versus the marketing hype.

The Appreciation Myth

According to the Federal Housing Finance Agency, US house prices have risen 4.5% annually over the past year. While this sounds impressive, it’s important to understand what this really means for investors.

First, this is gross appreciation, not net returns. When you factor in all ownership costs, many properties are barely breaking even or losing money despite rising values.

Second, appreciation rates vary dramatically by location and property type. While some markets see strong gains, others experience stagnation or decline. The national average masks significant regional variations.

Third, appreciation alone doesn’t create cash flow. A property that appreciates 5% annually but generates negative cash flow every month is destroying wealth, not building it.

The Cash Flow Challenge

Current rental yields in most major US markets are historically low. With median home prices at $414,000 and typical rental rates, many properties generate gross rental yields of 6-8% annually.

After accounting for all expenses, net rental yields often fall to 2-4% annually – before considering vacancy, major repairs, or market downturns.

Compare this to current dividend yields on quality stocks (2-4%) or bond yields (4-5%), and real estate’s risk-adjusted returns look far less attractive than commonly portrayed.

The Liquidity Reality

Recent data shows existing home sales declining and average time on market increasing in many areas. Properties that might have sold in days during the pandemic boom now sit for months.

This liquidity challenge becomes critical during market downturns or personal financial emergencies. Unlike stocks or bonds that can be sold immediately, real estate sales can take 3-6 months even in good markets, and much longer in challenging conditions.

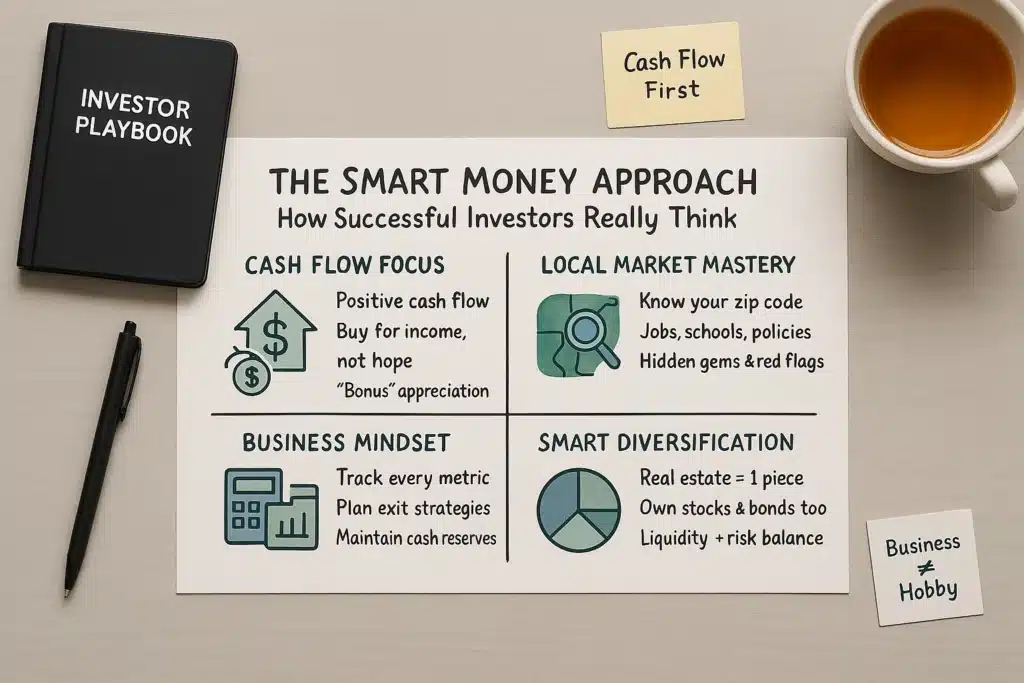

The Smart Money Approach: How Successful Investors Really Think

After analyzing thousands of successful real estate investors, certain patterns emerge that separate the winners from the losers.

They Invest in Cash Flow, Not Appreciation

Successful investors buy properties that generate positive cash flow from day one. They view appreciation as a bonus, not a requirement for profitability.

This approach provides several advantages: immediate income generation, protection against market downturns, and the ability to reinvest cash flow into additional properties or other investments.

Cash flow investors also tend to buy in less “sexy” markets where properties are priced for income generation rather than speculation.

They Understand Their Local Markets Intimately

The most successful real estate investors focus on specific geographic areas where they understand every factor that affects property values:

Employment trends, demographic shifts, infrastructure development, school district quality, and local government policies.

This local expertise allows them to identify opportunities before they become obvious to the broader market and avoid areas with hidden problems that could devastate returns.

They Treat It Like a Business, Not a Hobby

Successful real estate investors approach their investments with the same rigor they’d apply to any business venture.

They maintain detailed financial records, regularly analyze performance metrics, and continuously educate themselves about market trends and investment strategies.

They also maintain adequate reserves for unexpected expenses and have clear exit strategies for each property.

They Diversify Beyond Real Estate

Ironically, many of the most successful real estate investors don’t put all their money into real estate.

They understand that real estate is just one asset class and maintain diversified portfolios that include stocks, bonds, and other investments.

This diversification provides liquidity, reduces overall portfolio risk, and ensures they’re not overly dependent on real estate market performance.

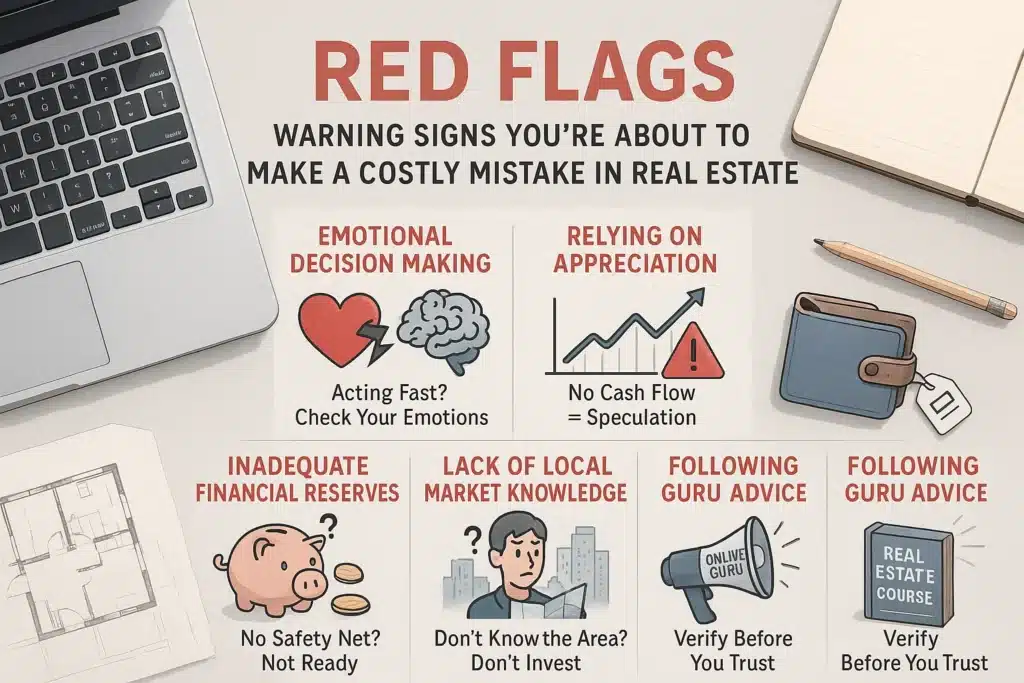

Red Flags: Warning Signs You’re About to Make a Costly Mistake

Before making any real estate investment, watch for these warning signs that indicate you might be gambling rather than investing:

- Emotional Decision Making. If you’re feeling pressure to “act fast” or “not miss out,” you’re probably making an emotional rather than analytical decision. Good investments don’t require immediate action without proper due diligence. Similarly, if you’re buying because you “love” the property or can “see the potential,” you’re likely letting emotions override financial analysis.

- Relying on Appreciation for Profitability. Any investment strategy that requires appreciation to be profitable is speculation, not investing. If the property doesn’t generate positive cash flow at current market rents, you’re gambling on future market conditions.

- Inadequate Financial Reserves. If you’re using all available cash for the down payment and closing costs, you’re not prepared for real estate investing. Successful investors maintain significant reserves for unexpected expenses, vacancy periods, and market downturns.

- Lack of Local Market Knowledge. Investing in areas you don’t understand intimately is a recipe for disaster. If you can’t explain why a specific property in a specific location will generate the returns you’re projecting, you don’t know enough to invest.

- Following “Guru” Advice Without Verification. The real estate education industry is filled with people selling dreams rather than practical knowledge. If someone’s primary income comes from teaching real estate investing rather than actually investing, be extremely skeptical of their advice.

The Path Forward: Making Smart Real Estate Decisions

- Start with Education, Not Action. Spend at least six months studying your local market before making any investment. Understand property values, rental rates, neighborhood trends, and local economic factors. Read financial statements of publicly traded real estate companies to understand how professionals analyze properties and markets.

- Begin with House Hacking or Small Multifamily. Consider starting with a duplex or small multifamily property where you can live in one unit and rent the others. This reduces your housing costs while providing real estate investment experience. This approach allows you to learn property management skills on a small scale while building equity in your primary residence.

- Focus on Cash Flow Markets. Look for properties in areas where rental yields are high enough to generate positive cash flow after all expenses. These markets may not be glamorous, but they provide the foundation for sustainable real estate investing.

- Build Your Team First. Develop relationships with quality contractors, property managers, accountants, and attorneys before you need them. Having reliable professionals makes the difference between success and disaster in real estate investing.

- Maintain Conservative Assumptions. Always underestimate income and overestimate expenses in your projections. Assume higher vacancy rates, more maintenance costs, and longer holding periods than you initially expect.

If you’re determined to invest in real estate despite these warnings, here’s how to approach it intelligently:

Conclusion: The Choice Is Yours

The real estate market will continue to exist, and opportunities will continue to emerge for those who approach it with knowledge, preparation, and realistic expectations.

But the harsh reality is that most people who think they’re real estate investors are actually gamblers hoping for easy money. The statistics don’t lie: 90-95% of new real estate investors fail within their first year.

The difference between the successful 5-10% and the failing majority isn’t luck, timing, or access to secret strategies. It’s approach, preparation, and realistic expectations about what real estate investing actually requires.

If you’re not prepared to treat real estate investing like a business, maintain significant financial reserves, spend considerable time managing your investments, and accept the possibility of losing money, then you’re better off investing in diversified index funds and focusing on building wealth through your career.

But if you’re willing to do the work, learn the skills, and approach real estate investing with the seriousness it deserves, it can be a valuable component of a diversified wealth-building strategy.

The choice is yours. Just make sure you’re choosing based on reality, not marketing hype.

Remember: in real estate, as in all investing, there are no shortcuts to wealth. The people who get rich quick in real estate are usually the ones selling courses to people who want to get rich quick in real estate.

Be smarter than that. Your financial future depends on it.

This article is for educational purposes only and should not be considered personalized financial advice. Always consult with qualified professionals before making investment decisions.