You can have the best-looking landing page, a killer ad creative, and a solid campaign structure—but if the offer itself is weak, none of that will matter. You’ll still lose money.

In affiliate marketing, picking the right offer to promote is half the battle. It’s a time-consuming process that often involves trial, error, and a lot of ad spend.

But here’s the part that trips people up: sometimes, one offer performs significantly better than another—despite using the exact same funnel and targeting. Why? Most marketers don’t really know.

Let’s dig into the overlooked factors that make or break conversions—and why even experienced affiliates often test the wrong things.

Table of Contents

ToggleThe “Ugly” Offer That Printed Me Money

About a year ago, I stumbled upon an affiliate offer that gave me a jaw-dropping 120% ROI.

Sounds amazing, right?

But here’s the twist: I almost didn’t run it.

It all started when my affiliate manager messaged me, urging me to test this “hot” new offer. So I clicked the link, took one look at the landing page—and immediately said “no way.”

The page was hideous. It looked like it was built in 2008, full of typos, and only paid a 15% commission.

So I skipped it.

Weeks went by, and I kept seeing alerts in the affiliate network dashboard: This offer is still hot!

Fine. I gave in. I decided to test it, just to see what the fuss was about.

That “ugly” offer ended up giving me an instant 30% ROI. It turned into a solid four-figure-per-day campaign—basically, free money.

If I had tested it earlier, I would’ve made a small fortune. That stung.

Back then, I couldn’t understand how such a low-payout, poorly designed offer was converting so well.

Now I do—and that one campaign taught me a lesson that’s made me a much better affiliate.

These days, I can often predict whether an offer has profit potential even before testing it. And if I know it has legs, I’ll even negotiate with the advertiser for exclusive rights or a custom landing page to scale it harder.

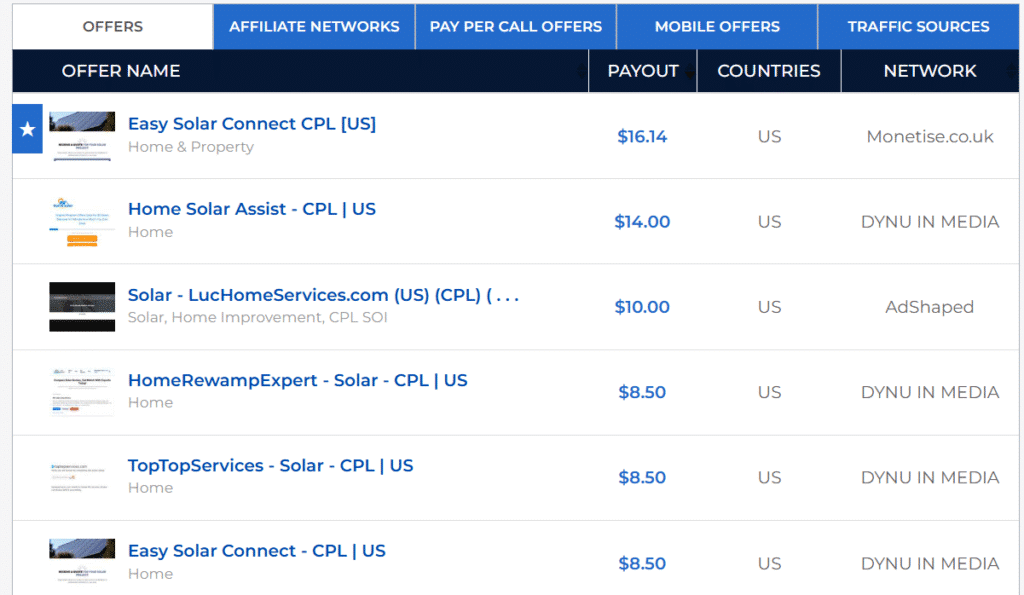

Why Lead Gen Offers Fail: The Data Depth Problem

Lead generation offers are simple on the surface: a user fills out a form—name, email, phone number, maybe a few more details—and you get paid anywhere from $4 to $15 per lead.

Take solar panel offers, for example. A user submits their info, and shortly after, they get a phone call from a sales rep trying to close a solar installation deal. (Or sometimes they just get a barrage of marketing emails.)

Now here’s the hidden catch: what if that user—say, John Smith—has already submitted his info in the past?

If John is already in the advertiser’s database, they’re not going to pay again for that lead. You lose the commission.

But how did John’s data end up there in the first place?

- Maybe he signed up last year and simply forgot.

- Maybe the advertiser runs multiple solar-related websites, and John thought he was filling out a new form—but it was all connected to the same backend.

- Maybe another affiliate reached him earlier with a completely different angle.

- Or maybe John already talked to a sales rep, said no, and the advertiser gave up on him. In that case, they won’t pay again for another failed attempt.

The result? You’re running a campaign with seemingly solid targeting, good angles, a clean landing page—and yet conversions are low or completely absent.

Even premium offers aren’t immune to this issue. You might be promoting a trusted brand like eHarmony, with a slick website and a strong domain name.

But if their data is stale—if most of the leads are already in their system—you may end up with a lower ROI compared to a lesser-known offer that’s working with fresh leads.

Payment Methods That Kill or Boost Conversions

One day, I walked up to a restaurant and saw a big sign on the door: Cash Only.

I turned around and left—I didn’t have any cash on me. They lost a customer, just like that.

That’s the power of payment options.

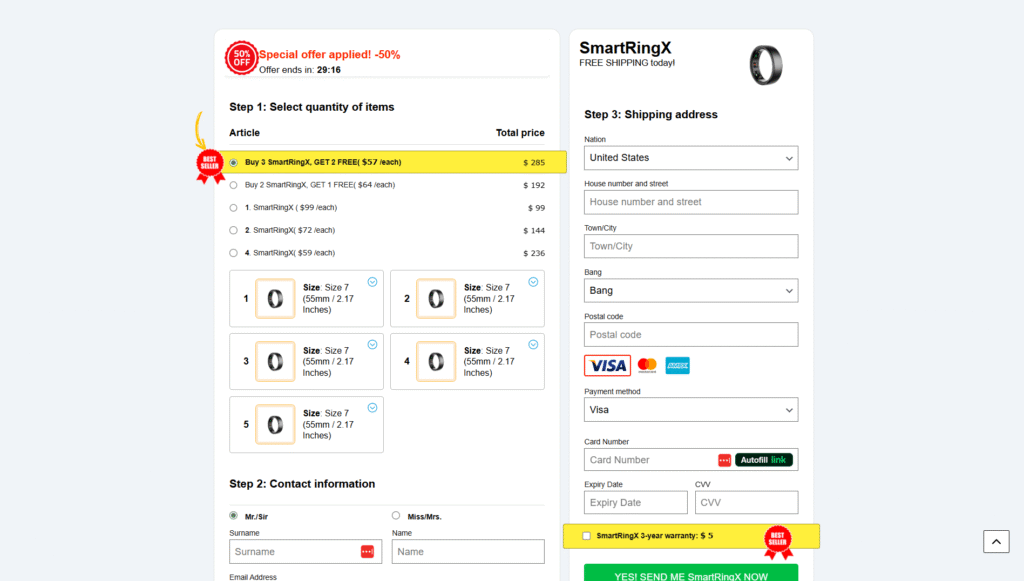

When you’re selling something, the way people pay matters. Imagine running an offer that only accepts Mastercard but not Visa. (Yes, I’ve seen this happen.)

Suddenly, tons of potential buyers can’t check out—not because they don’t want to buy, but because they literally can’t.

In less developed countries, many people don’t even own a credit card. So if an advertiser supports multiple payment methods, conversions can go up dramatically.

Here are a few alternative payment options that can boost conversions:

- Cash on delivery

- Bank transfer

- PayPal

- Local e-wallets

If you notice that one offer outperforms another, sometimes the answer is this simple: better, more accessible payment options.

Your Offer’s Tech Stack Could Be Killing Your ROI

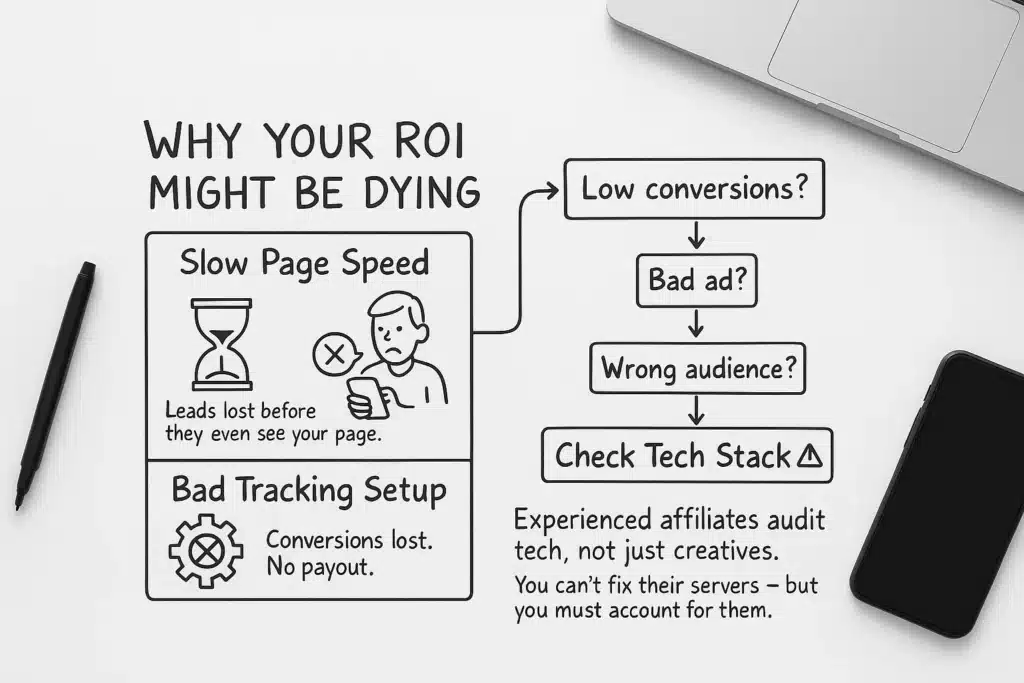

Most affiliates obsess over creatives and angles—but overlook a silent killer of conversions: the offer’s tech stack.

Let’s start with something simple: page speed.

If the landing page takes forever to load—especially on mobile—you’re going to lose potential leads right there. People bounce. Not because the angle was bad, not because the ad didn’t work, but because the page didn’t show up fast enough.

But there’s another hidden problem: conversion tracking software.

Some advertisers use outdated or poorly configured tracking systems that miss clicks or drop conversions. This means your traffic might actually be converting—but you’re not getting paid for it.

You can’t control their servers or fix their tracking setup—but it still affects your bottom line.

And here’s the kicker: you might test an offer, see low performance, and assume it’s the ad or audience. But in reality, it could be a technical issue on the advertiser’s side.

That’s why experienced affiliates always pay attention to the tech layer behind every campaign—not just the payout or landing page design.

Are You Sending the Right Traffic? Check These First

Sometimes, it’s not the offer that’s broken—it’s the traffic.

Even a high-converting offer will flop if you’re not targeting correctly.

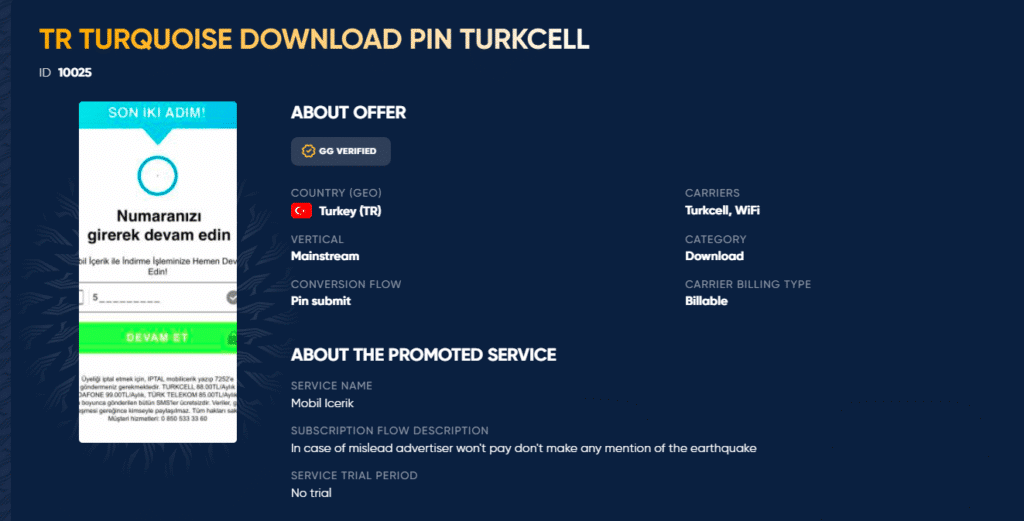

For example, imagine the offer only accepts traffic from Android devices, but you’re sending iPhone users. No conversions.

Or maybe the offer is restricted to users on a specific mobile carrier—let’s say Turkcell—but you’re sending traffic from Vodafone Turkey. Again, no conversions. Not because your ad was bad, but because the offer literally can’t accept that kind of traffic.

That’s why targeting rules matter.

If you ignore device type, carrier restrictions, geo filters, or even time zone limitations, you could be burning budget on completely ineligible clicks.

And here’s the painful part: you might assume the offer is garbage—when in fact, it’s a great offer. You just didn’t read the fine print. You sent the wrong traffic, got poor results, and walked away without ever giving it a fair shot.

Double-check your targeting. It could be the difference between a failing campaign and a winner.

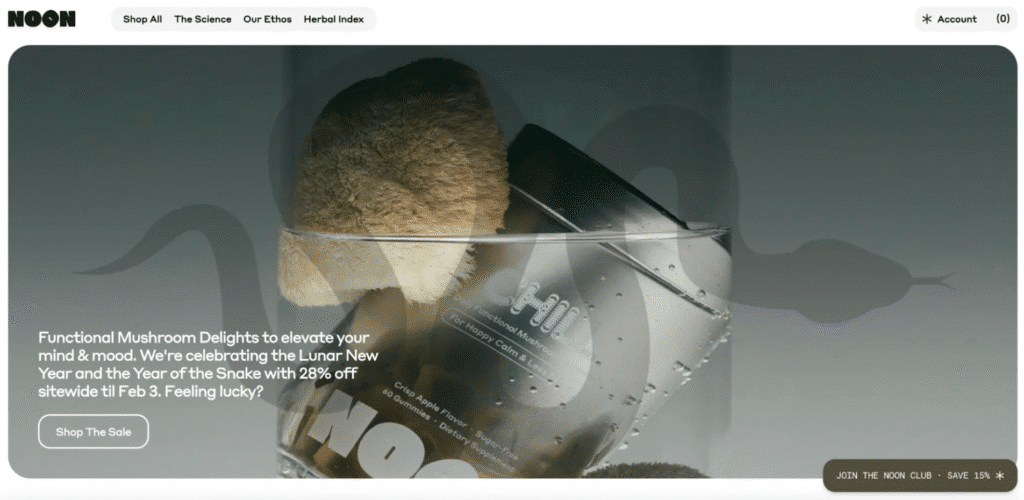

Great Design ≠ High Conversions: When Pages Fail

When conversions are low, most affiliates start by looking at the offer’s landing page design. And often, they assume that a beautiful page equals high conversion rates.

But good design doesn’t always mean good performance.

In fact, some ugly, outdated pages convert like crazy—because the content is compelling, the reviews look authentic, and the page is packed with persuasive elements.

Meanwhile, some sleek, modern pages look completely compliant and “by the book”… and they don’t convert at all.

Why? Because strict compliance can kill urgency and reduce frictionless conversions.

There are legal requirements in many regions—like mandatory checkboxes, visible “Terms & Conditions,” and clear disclaimers. Some advertisers follow every rule. Others quietly ignore a few of them to make more sales.

Yes, those “non-compliant” pages often convert better. But here’s the risk: short-term gain can lead to long-term pain.

Getting an extra $5 commission might feel great—until you get hit with a six-figure lawsuit or have your ad account shut down.

It’s a real risk. So if you see a high-converting offer with a sketchy page, think twice before scaling it blindly. Know what you’re getting into.

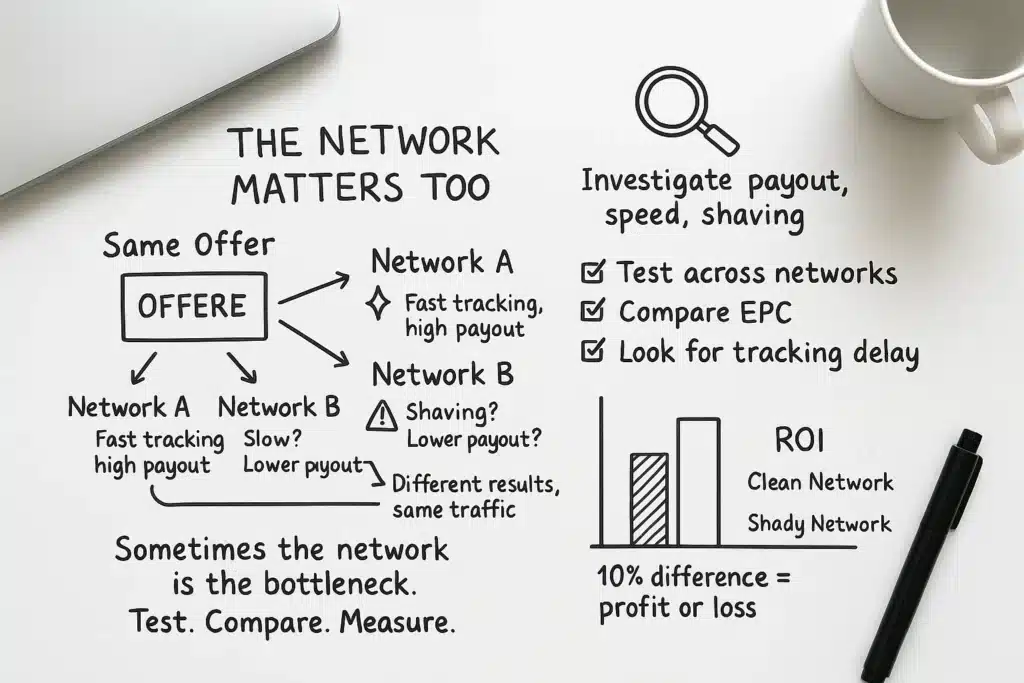

Affiliate Networks: The Hidden Factor Behind Bad Performance

When analyzing why an offer isn’t converting, most affiliates focus on the offer itself—but the affiliate network behind it also plays a critical role.

Things like the payout level, server speed, and even whether the network is shaving conversions (yes, it happens) can all affect your results.

Here’s the hard truth: some networks quietly skim leads, delay tracking, or offer lower payouts compared to others running the exact same offer.

That’s why it’s always smart to split test the same offer across multiple networks—especially if you see it performing well but feel like you’re leaving money on the table.

Not all networks are shady. There are great ones with reliable tracking, strong relationships with advertisers, and honest practices. But let’s not kid ourselves—there are also networks that’ll eat into your ROI without you ever realizing it.

Test. Compare. Measure. A 10% bump in payout or cleaner tracking could mean the difference between a break-even campaign and a profitable one.

The Commission Isn’t Always What It Seems

Yes, you heard that right—don’t obsess over commission rates or EPC numbers. Let me show you why with a simple example.

Let’s say you’re comparing two offers:

- Offer A – $10 commission

- Offer B – $9 commission

Most affiliates see the higher payout on Offer A and immediately go with it—often without even giving Offer B a shot.

But what if those payouts aren’t telling the full story?

Let’s say the real commissions look like this:

- Offer A – $10 on paper, but the advertiser shaves 20% of your clicks. So your effective payout is actually around $8

- Offer B – $9 with clean, accurate tracking

In that case, Offer B is clearly the better deal—even though it looked worse on the surface.

So no, you shouldn’t blindly chase the highest numbers on the payout sheet.

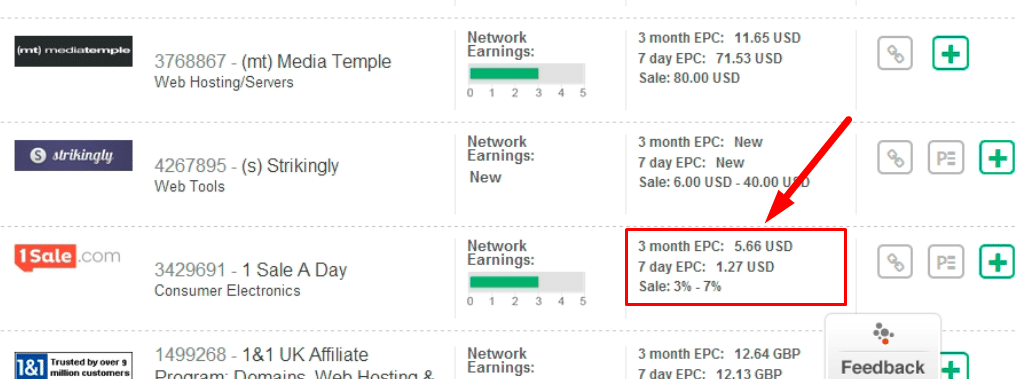

EPC Looks Useful—But Don’t Trust It Blindly

What about EPC—Earnings Per Click? That’s another stat many affiliates overvalue, especially when they’re new.

I used to judge offers purely based on EPC. If the EPC was low, I assumed the offer didn’t convert well.

But here’s the catch: EPC data can be completely misleading.

Maybe one affiliate is driving junk traffic—direct from pop or PPV sources—straight to the offer page with no pre-lander, no qualification, no intent. That will tank the overall EPC.

You might be running high-quality paid traffic with a solid presell flow that generates $3 EPC, while the average EPC shown on the network is $0.10. Does that mean the offer is bad? Not at all.

Raw data means nothing without proper interpretation. The numbers are helpful—but only if you understand what’s behind them.

Final Thoughts: Don’t Judge an Offer by Its Cover

Just like you shouldn’t judge a book by its cover, you shouldn’t judge an offer by how it looks on the surface.

An ugly landing page might convert like crazy. A low EPC might be hiding a goldmine. A lower commission might actually mean higher profit—once you dig into the tracking and targeting.

The only way to know for sure? Test smart, track everything, and let the numbers speak for themselves.

In affiliate marketing, assumptions will cost you. Data will guide you.

So before you write off that “weird-looking” offer—give it a fair shot. You might be leaving real money on the table.